Calculate net present value online

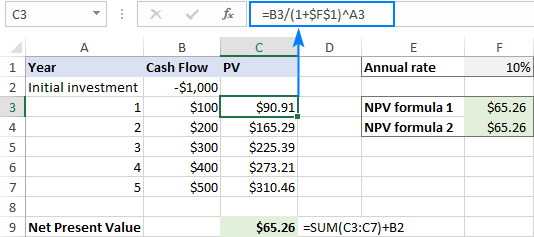

I recommend writing these figures down in an itemized spreadsheet. Once we calculate the present value of each cash flow we can simply sum them since each cash flow is time-adjusted to the present day.

How To Use The Excel Npv Function Exceljet

The textbooks definition is that the net present value is the sum Σ of the present value of the expected cash flows positive or negative minus the initial investment.

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

. For example to find the present value of a series of three 100 payments made at equal intervals and discounted at 10 you can perform these calculations. A Managers Guide. Lets say we want to calculate the present value of these payments.

Present Value Net Present Value. However when subtracting only half the carbs from sugar alcohols the net carb value is 85 grams. Net Present Value - NPV.

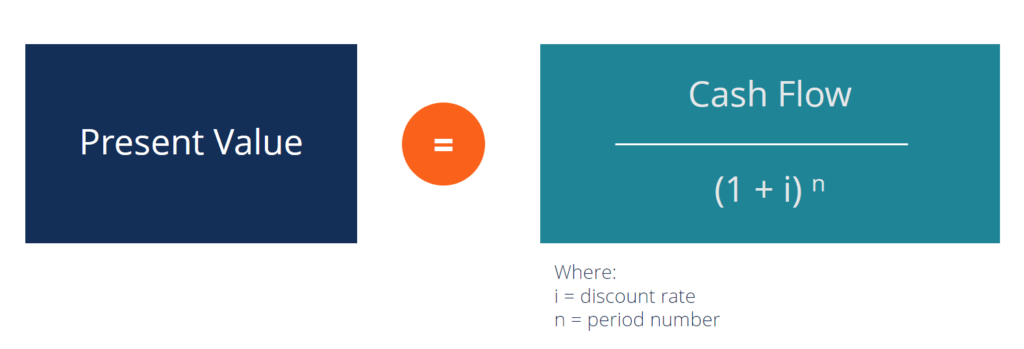

This is the concept of present value of a single amount. I put a dollar sign behind the column. Present Value or PV is defined as the value in the present of a sum of money in contrast to a different value it will have in the future due to it being invested and compound at a certain rate.

NPV is used in capital. The expected net cash flow for three years are to be 45004000 and 5500 repectively. In this case our net present value is positive meaning that the project is a.

23 grams of total carbs 9 grams of fiber 11 grams sugar alcohols 11 grams X 05 55. Salvage Value Formula Example 3. The previous section shows how to calculate the present value of annuity manually.

Once you have this information the formula to calculate net worth is simply. NPV net present value. Lets calculate the internal rate of return for these period.

Assets Liabilities Net Worth. Suppose a company plans to invest in a project with initial investment amount of 10000. Similarly we have to calculate it for other values.

How to calculate present value in Excel - formula examples. If you calculate the present value of each of these payments the summation of that discounted cash flow should be equal to this net present value. First we have to calculate the Present Value.

Calculate the Salvage value of the machinery after 10 years. The output will be. An Example of Net Asset Value Calculation under a Going-Concern Scenario.

May 5 2021 at 1256 pm Please could you help with this situation. Given our time frame of five years and a 5 interest rate we can find the present value of that sum of money. Net Present Value Definition.

Therefore the salvage value of the machinery after its effective life of usage is INR 350000. August 22 2021 at 255 pm Thank for the insightful information Reply. Once we sum our cash flows we get the NPV of the project.

Your net present value is the difference between the present value and your expected cash outflow or total expenses for the period. You enter money invested as a negative number. Assume that the company will continue operating business as usual.

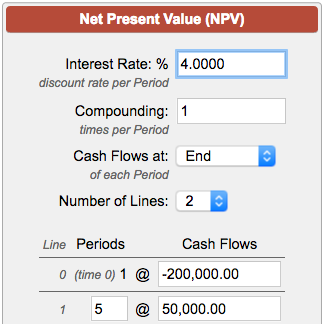

A popular concept in finance is the idea of net present value more commonly known as NPV. The valuation expert should obtain the latest available financial position as of the valuation date and determine the market values of each asset class. In addition to the projected cash flow the user sets five values.

The first one equals 50000 divided by 1 plus interest rate. Is the difference between the present value of cash inflows and. To calculate the net present value the user must enter a Discount Rate The Discount Rate is simply your desired rate of return ROR.

The Net Present Value is difficult to calculate by hand since the formula is very complex. If your PV is 148819 and you expect your cash outflow to be 250 then your NPV 148819 - 250 123819. Lets quickly calculate that.

5 comments to How to calculate NPV in Excel - net present value formula examples Amir says. See Present Value Cash Flows Calculator for related formulas and calculations. It shows you how much a sum that you are supposed to have in the future is worth to you today.

Calculate Net Present Value. The amount of depreciation is INR 100000 per year. Subtract the cash outflow from the present value to find the NPV.

The idea is to calculate the NPV. The first amount invested. How to Calculate IRR with example.

Net Present Value is calculated using the formula given below. Calculate the net present value NPV of a series of future cash flows. Net Present Value NPV is the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

Net Present Value is a frequently used financial calculation used in the business world to define the current value of cash inflows produced by a project asset product or other investment activities after subtracting the associated costs. That way you can be sure everything is accounted for. Is the current value of a future sum of money discounted by a specified rate of return.

Interest Rate discount rate per period. To learn more about how you can use net present value to translate an investments value into todays dollars I spoke with Joe Knight co-author of Financial Intelligence. NPV CF n 1 i n Initial Investment.

We are applying the concept to how much money we need to buy a business. Using the NPV Calculator. More specifically you can calculate the present value of uneven cash flows or even cash flows.

Another way to understand what is meant by present value is to consider a situation in which one considers a business investment of 500000 expected to bring a cash flow. BHEL Limited installed Engineering machinery costing INR 1000000 has a useful life of 10 years. The net worth formula will present you with a specific monetary value which is considered to be your net worth.

Calculate Npv In Excel Net Present Value Formula

/NPV2-eb0a220d0e72459bbae81de6f237b6a0.png)

Net Present Value Npv What It Means And Steps To Calculate It

Npv Formula Learn How Net Present Value Really Works Examples

/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

Calculate Npv In Excel Net Present Value Formula

Npv Calculator Calculate Net Present Value

/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

Formula For Calculating Net Present Value Npv In Excel

:max_bytes(150000):strip_icc()/NPVFormula-5c23ea8f46e0fb00013d2624.jpg)

Net Present Value Vs Internal Rate Of Return

Formula For Calculating Net Present Value Npv In Excel

:max_bytes(150000):strip_icc():gifv()/NPV2-eb0a220d0e72459bbae81de6f237b6a0.png)

Net Present Value Npv What It Means And Steps To Calculate It

Present Value Of An Annuity How To Calculate Examples

Npv Formula Learn How Net Present Value Really Works Examples

Calculate Npv In Excel Net Present Value Formula

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

Net Present Value Npv What It Means And Steps To Calculate It

Excel Discount Rate Formula Calculation And Examples

Net Present Value Calculator